Maximum Benefits for a Major Medical Plan Are Usually Lifetime

Generally major medical plans can no longer have lifetime maximum coverage limits for essential health benefits. Maximum benefits for a major medical plan are usually lifetime.

A lifetime limit was the maximum amount a health plan would pay for your care.

. Total lifetime maximum for all benefits received through the Blue Cross Blue Shield PPO option. 0 Tonly O ll only O Both I and II O Neither I nor 11. A lifetime maximum is the maximum dollar amount that will be paid on your behalf under any HMSA plan thats sponsored by the same employer or contract holder for the same group health plan.

Maximum benefits for a major medical plan are usually lifetime. LIFETIME COMPREHENSIVE MAJOR MEDICAL COVERAGE. Insurance companies can no longer set a dollar limit on what they spend on essential health benefits for your care during the entire time youre enrolled in that plan.

In a POS plan benefits for covered services when self-referring without having your primary care physician arrange for the service are generally More expensive Maximum benefits for a major medical plan are usually lifetime. What policy feature in major medical policies allows the maximum lifetime benefit to be restored to its original amount after a large portion of the benefits have been used. Unlimited In-Network Out-of-Network DEDUCTIBLEPer individual per calendar year.

-Minimums -Maximums -Open panel -Closed panel. Medicare is the secondary payer during the first 30 months of treatment. See your Guide to Benefits for more information and the dollar amount applicable to your plan.

Under most policies the lifetime maximum applies only to non-essential healthcare services. When deductible amounts increase premium amounts _____. Therefore the maximum does not apply to.

Major medical plans generally contain a coinsurance provision which provides that the plan will pay only a specified percentage of the covered expenses that exceed the deductible. A lifetime limit is the maximum dollar amount that an insurance company would pay for benefits for as long as an individual was a member of. Subject to deductible and coinsurance for.

Major medical plans have high maximum benefits such as 1000000 or 2000000. A lifetime maximum is the maximum amount that your insurance benefit will provide during your lifetime. Major medical healthcare insurance plans provide broad coverage and significant protection from large unpredictable and therefore catastrophic health care expenditures.

What is a lifetime maximum benefit. During a sales presentation a producer intentionally makes a statement which may mislead the insurance applicant. Policies issued on or renewing after September 23 2010 are required to have no.

Which of the following would be a typical maximum benefit offered by major medical plans. If the insured suffers a 50500 medical expense during the calendar year what is the remaining lifetime benefit. Blue Cross Blue Shield PPO Schedule of Benefits.

Maximums PQ Major medical plans have high maximum benefits such as 1 MIL or 2 MIL. Individuals eligible for Medicare because of end-stage renal disease ESRD and covered under the employers group plan are primarily covered by the group health coverage for the first 30 months then Medicare would become the primary health provider. The plan has a 500 deductible and an 80 coinsurance.

Under which provision can a physician submit claim information prior to providing treatment. Maximum benefits are usually lifetime maximums. At the same rate as the policy loan.

If a death benefit is not paid out in a timely manner the interest begins to accrue. Maximum benefits are usually lifetime maximums. The ACA did away with lifetime benefit maximums for essential health benefits.

Subject to deductible Plan pays 80 of the next 5000 of eligible expenses then 100 to the overall maximum per period of coverage. In a group prescription drug plan the insured typically pays what amount of the drug cost. Since the Affordable Care Act.

Major medical plans have high maximum benefits such as 1000000 or 2000000. Maximum benefits for a major medical plan are usually lifetime. Lifetime maximum benefit or maximum lifetime benefit is the maximum dollar amount a health plan will pay in benefits to an insured individual during that individuals lifetime.

50 of deductible waived up to a maximum of 2500. When that limit was reached you had to start paying out of pocket. From the beginning most.

The health care law stops insurance companies from limiting yearly or lifetime coverage expenses for essential health benefits. An individual is insured under a major medical plan with a 1000000 lifetime benefit.

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)

Life Vs Health Insurance Choosing What To Buy

Health Insurance Plans Saskatchewan Blue Cross

Axa Health Max Visual Ly Health Medical Conditions Health Care

The Ultimate Vitamin K2 Resource Chris Masterjohn Phd Cancer Help Vitamin K2 How To Increase Energy

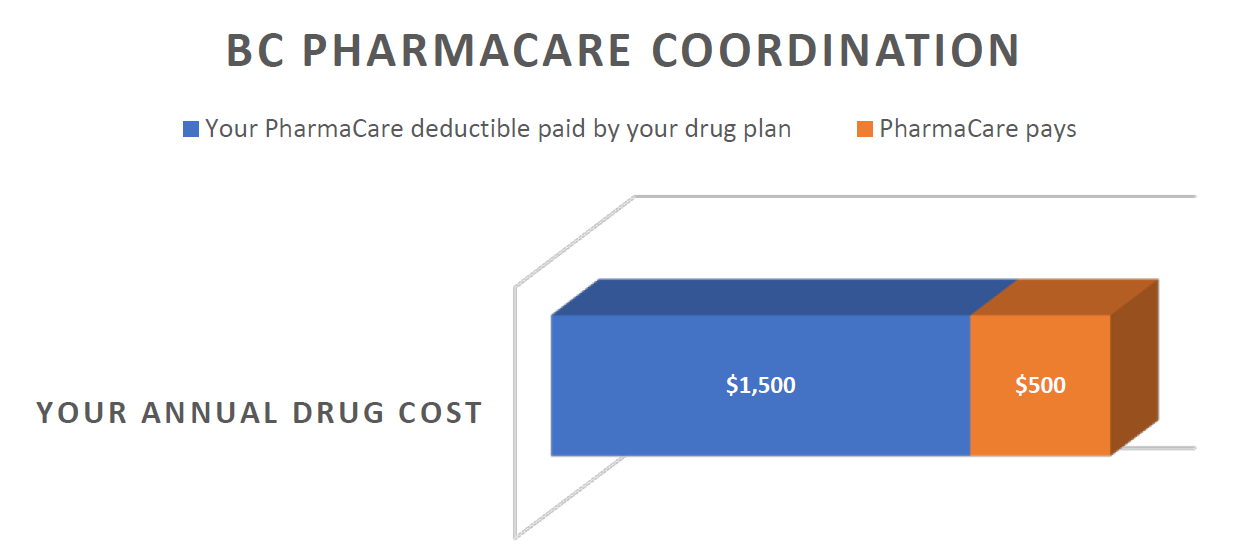

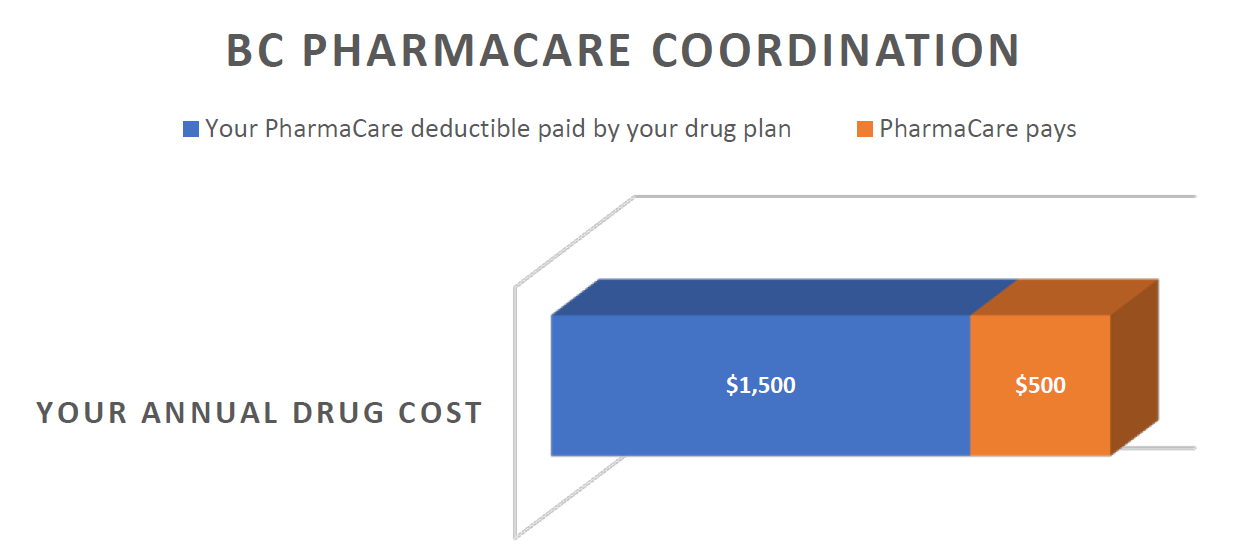

Benefits For Bargaining Unit Employees Province Of British Columbia

Pin On All Things Ovarian Cancer

Terms Of Renewal Relatable Health Plan Renew

7 Ways To Develop A Life Time Reading Habit Reading Habits How To Read More Importance Of Reading

Best Life Insurance Canada 2022 Company Reviews Policyadvisor

Framed Urine Color Chart Pee Color Chart Water Intake Chart Etsy Pee Color Water Intake Chart Pee Chart

Iron Is Too Much Harmful Infographic Sugar Detox Hemochromatosis Diet Vitamin C Foods

Comments

Post a Comment